4.14 Stockholder Equity and Securities

As of 31.12.2022, the charter capital of the Company totaled RUBruble 8,743,048,571.1 (or 87,430,485,711 common shares with par value of RUBruble 0.1 each). OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals has not placed preferred shares.

| Shares | Quantity | Face value |

|---|---|---|

| Outstanding ordinary shares | 87,430,485,711 | RUB 0.1 |

| Authorized ordinary shares | 2,475,713,367 | RUB 0.1 |

There were no changes of the Company’s charter capital during 2022, no additional shares were issued or placed in 2022.

As of 31.12.2022, the register comprises 16,140 registered accounts, incl. 7 nominal holders, 97 legal entities, 15,892 individuals, 143 common-property accounts and 1 undefined owner account.

| State registration number | 1-01-32501-D dated 03.05.2005 |

|---|---|

| ticker | MRKU |

| ISIN | RU000A0JPPT1 |

Ordinary shares of the Company are listed in Level 2 Quotation List of PAOPublic Joint-Stock Company Moscow Exchange, they are also included into the Energy Sector Index (MOEXEU), Broad Market Index (MOEXBMI), National Corporate Governance Index (RUCGI), RTS Broad Market Index (RUВMI) and RTS Energy Sector Index (RTSeu).

OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals has no information on other blocks of stock over 5% except for these already disclosed above. Shares owned by the Company and its controlled entities: none. Information on certain stockholders’ potential or actual control, stretching out beyond their stakes in the charter capital (incl. shareholder agreements): none. Ordinary and preferred shares of unequal par value: none.

The Company’s shareholder structure, % [1]:

As of 31.12.2022

As of 09.01.2023

Post-reporting events:

The Rosseti Group’s restructuring ended on 09 January 2023. Public Joint-Stock Company Russian Grids (owning 51,52% in the OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals’ charter capital), АОJoint-Stock Company DVUEK ENES (possessing 3.71% of OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals), AOJoint-Stock Company Kuban Backbone Grids and AOJoint-Stock Company Tomsk Backbone Grids have merged into Public Joint-Stock Company Federal Grid Company – Rosseti (abbreviated corporate name – PAOPublic Joint-Stock Company Rosseti), as it became the parent company of the Group. In the course of the restructuring the interest of PAOPublic Joint-Stock Company Rosseti in OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals increased to total 55.23%. There were no other changes among entities with direct or indirect control of 5%+ of votes attributed to voting shares in 2022.

‘

The Russian legislation guarantees that any common share gives equal rights to any shareholder. Therefore, our shareholders are entitled to:

- Participate in a General Meeting of Stockholders (in person or by proxy) with voting power on all respective matters.

- Introduce own proposals to the agenda of a General Meeting of Stockholders in a manner set forth by the Russian legislation and Company’s Charter.

- Obtain information on the Company and get familiarized with Company’s documents in line with Article 91 of the Federal Joint-Stock Companies’ Law, other regulatory enactments and Charter.

- Collect dividends announced by the Company.

- Preemptive acquisition of additional shares and convertible securities, placed by subscription, pro rata to the ownership in cases stipulated by the Russian legislation.

- Obtain parts of the Company’s property in case of its liquidation.

- Enjoy other rights guaranteed by the Russian legislation and Charter.

A stockholder or a group of stockholders with at least 2% of the voting stock are entitled to introduce issues to the agenda of a General Meeting of Stockholders and promote nominees for election to the Board of Directors and Board of Internal Auditors of the Company. A stockholder or a group of stockholders with at least 10% of the voting stock are entitled to initiate an extraordinary General Meeting of Stockholders of the Company.

The rights of IDGCInterregional Distribution Grid Company of Urals’ stockholders are guaranteed by the following:

- The Company publicly discloses:

- the General Meeting of Stockholders notice and materials on agenda items within 30 days prior to the General Meeting;

- recommendations provided by the Board of Directors regarding items of the General Meeting agenda through press releases, corporate actions/events and minutes of the Board of Directors’ meetings;

- date when entities, entitled to participate in the General Meeting of Stockholders, are defined within 7 days prior to the record date;

- minutes of the meetings of stockholders on the corporate web-site.

- The Company’s stockholders may submit proposals to be included into the agenda of the annual general meeting of stockholders within 60 days after the end of the calendar year.

- Registration of entities, entitled to participate in the general meeting of stockholders, is stipulated in details by the Regulations on the General Meeting of Stockholders.

- The Company’s registrar performs the functions of the Counting Commission during the general meeting of stockholders. Since December 2010 the Company’s registrar is AO STATUS (official web-site: www.rostatus.ru).

- Voting results at the general meeting of stockholders are announced prior to the conclusion of the meeting and disclosed in a statutory manner.

- The Company has the Dividend Policy stipulating primary principles of dividend payments, mechanics of dividend decision-taking, procedure, deadlines and form of dividend payments. The relevant Policy is disclosed on the official web-site of the Company[2].

The decision to pay dividend allows stockholders to receive full details regarding dividend amount, payment procedure and deadlines.

‘

| 2020 | 2021 | 2022 | 2022/2021, % | |

|---|---|---|---|---|

| Market capitalization as of the last trading day, RUBruble billion | 14.1 | 15.4 | 17.2 | +11.3 |

| Trading volume, RUBruble million | 450.2 | 622.3 | 989.3 | +59.0 |

| Trading volume, billion shares | 3.1 | 3.4 | 5.8 | +70.6 |

| Transactions, thousand | 40.9 | 55.6 | 88.8 | +59.7 |

The Company’s market value as of the last trading day (30.12.2022) totaled RUBruble 17.2 billion.

Fluctuations of the OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals market capitalization in 2022 (RUBruble billion)

Source: Moscow Stock Exchange (www.moex.com).

Fluctuations of OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals stock quotes, indices of the Moscow Stock Exchange (IMOEX and MOEXEU) in 2022 (%)

Source: Moscow Stock Exchange (www.moex.com).

In 2022, geopolitical risks occurred during 2022 had a negative impact on the Russian stock market.

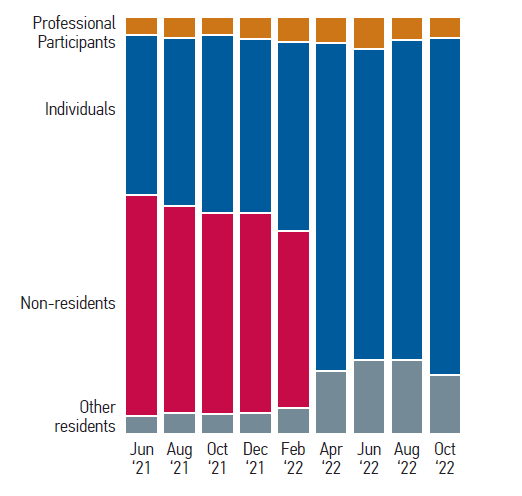

Source: Bank of Russia

Large market players (incl. Russian ones) desisted from transactions. According to the data, provided by the Bank of Russia, by November 2022 the private investors contributed 80% to the total trading volume on the equity market, while their contribution in 2021 was around 40%.

During 1Q2022 the fluctuations of the Company’s stock quotes mainly copycatted the IMOEX and MOEXEU movements. Since 1Q2022, on the back of solid production and financial results and news on FY2021financial year 2021 and 9M2022 dividends, the Company’s stock quotes outperformed IMOEX and MOEXEU, ending the year in the black. The price for the Company’s shares gained 11.3% during 2022, starting from RUBruble 0.1766 average weighted price of the last trading day of 2021) and ending RUBruble 0.1966 (average weighted price of the last trading day of 2022). IMOEX has lost 43.1% by the year-end. MOEXEU was a little bit better but still ended in the red: decrease totaled 27.1% by the year-end.

IDGC of Urals’ trading volume in RUB million in 2022 (main market)

Source: Moscow Stock Exchange (www.moex.com).

IDGC of Urals’ trading volume in million shares in 2022 (main market)

Source: Moscow Stock Exchange (www.moex.com).

Number of transactions with OAO IDGC of Urals shares in 2022, thousand (main market)

Source: Moscow Stock Exchange (www.moex.com).

Due to increased demand for the Company’s shares, the annual trading volume in monetary terms and quantitative terms totaled RUBruble 989.3 million (+59.0% YoYyear on year) and 5.8 billion shares (+70.6% YoYyear on year), respectively. The annual number of transactions amounted to 88.8 thousand (+59.7% YoYyear on year).

Bonds

The Company placed no exchange-traded bonds in 2022. Key parameters of exchange-traded bonds in circulation as of 31.12.2022:

| Key parameters of securities | Series BO-03 exchange-traded bonds | Series BO-04 exchange-traded bonds |

|---|---|---|

| ID / Registration number | 4B02-03-32501-D | 4B02-04-32501-D |

| Date of ID / Registration number assignment | 31.05.2013 | 31.05.2013 |

| Amount | 3,000,000 | 4,000,000 |

| Face value, RUBruble | 1,000 | 1,000 |

| Volume, RUBruble thousand | 3,000,000 | 4,000,000 |

| Placed on | 30.10.2019 | 30.10.2019 |

| Maturity | 10 years | 10 years |

| Offer / Redemption | 27.10.2025/17.10.2029 | 27.10.2025/17.10.2029 |

| Coupon rate, % p.a. | 8.80 | 8.80 |

| Coupon yield per bond, RUBruble | 43.88 | 43.88 |

| Exchange | PAOPublic Joint-Stock Company Moscow Exchange | PAO Moscow Exchange |

| Listing | 2 | 2 |

| Debt as of 31.12.2022, RUBruble thousand | 10,267 | 2,999 |

During the circulation period, in particular, in 2021, the Company complied with its obligations to pay out coupons in due terms and in full. Upon request from the owners on 31.10.2022 the issuer acquired 6,986,734 BO-03 Series and BO-04 Series ETB, presented for redemption.

In 2022, the list of securities admitted for trading at PAOPublic Joint-Stock Company Moscow Exchange also contained the following bonds:

- RUBruble 1,600 million BO-02 Series ETB (ID No. 4B02-02-32501-D dated 31.05.2013),

- RUBruble 5,000 million BO-05 ETB (ID No. 4B02-05-32501-D dated 31.05.2013).

The BO-02 Series and BO-05 Series ETB were acquired by the Company in full in 2019 and cancelled in 2022.

The Company has also registered Series 001R Exchange-Traded Bond Program (ID No. 4-32501-D-001P-02E dated 08.02.2017). Total ceiling par value of exchange-traded bonds to be placed under the program is RUBruble 25.0 billion. Maximum maturity of exchange-traded bonds to be placed under the program is 30 years since the effective date. The maturity of the ETB program is 50 years since the date of the ID assignment to the Program.

‘

The Company’s dividend policy focuses on the enhancement of the Company’s investment prospects and market value, balancing between interests of the Company and its stockholders. The Company’s dividend policy is stipulated by the Regulations on the Dividend Policy[98].

Fundamentals of the Company’s Dividend Policy

- Compliance of the Company’s dividend accrual and payout practices with laws of Russia and corporate governance standards [99];

- Optimum compromise between the interests of the Company and its stockholders;

- Specification of a dividend size at a minimum of 50% of net income, presented in the financial statements (incl. consolidated statements, prepared under IFRSInternational Financial Reporting Standards), calculated in a manner stated by the Regulations;

- Provision of possibility to pay quarterly dividends, provided that corresponding criteria are complied with;

- Enforcement of utmost transparency (comprehensibility) of a tool for dividend size calculation and payout;

- Enforcement of dividend upward trend, provided that Company’s net income keeps growing;

- Availability of information on the Company’s dividend policy for stockholders and stakeholders;

- Maintenance of required financial and technical condition of the Company (execution of investment program), enforcement of the Company’s development.

Allocation of profit in 2019-2021*

| 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|

| (AGM held in 2019) | (AGM held in 2020) | (AGM held in 2021) | (AGM held in 2022) | |

| Unallocated profit (loss) of the reported period, incl: | 797,526 | 2,155,068 | 19,328 | 5,173,722 |

| • Reserve fund | 0 | 0 | 0 | 0 |

| • Enterprise development | 535,235 | 1,237,048 | 19,328 | 2,996,708 |

| • Dividends | 262,291 | 918,020 | 0 | 2,177,019 |

| • Recovery of losses of previous periods | 0 | 0 | 0 | 0 |

Pursuant to the Company’s charter, the Annual General Meeting of Stockholders will decide upon allocation of the FY2022financial year 2022 profit.

‘

OAOOpen Joint-Stock Company IDGCInterregional Distribution Grid Company of Urals aims to promptly and regularly convey information about its operations to all those interested in receiving it to the extent necessary for them to make an informed decision about acquiring an interest in the Company or other actions that are capable of affecting the Company’s financial and business operations.

The Company maintains a special web-page (https://www.rosseti-ural.ru/en/ir/), with answers to frequently asked questions from stockholders and investors, a regularly updated calendar of corporate events, dividend history, key performance indicators as well as other information that investors and stockholders may find useful.

The Company also uses its official web-page at Interfax newswire system (http://www.e-disclosure.ru/portal/company.aspx?id=12105) to disclose corporate events or actions, annual and quarterly reports, accounting (financial) statements, etc.

| USEFUL LINKS | |

|---|---|

| FINANCIAL REPORTING | |

| under Russian Accounting Standards | https://rosseti-ural.ru/en/ir/financial-information/ras/ |

| under International Financial Reporting Standards | https://rosseti-ural.ru/en/ir/financial-information/ifrs/ |

| IR CALENDAR | https://rosseti-ural.ru/en/ir/analyst-center/ir-calendar/ |

| QUICK ANALYZER | https://rosseti-ural.ru/en/ir/analyst-center/quick-analyzer/ |

| INFORMATION DISCLOSURE | |

| Corporate actions and events | https://rosseti-ural.ru/en/disclosure/issuer/corporate-actions/ |

| Lists of affiliated entities | https://rosseti-ural.ru/en/disclosure/issuer/affiliate/ |

| Quarterly reports | https://rosseti-ural.ru/en/disclosure/issuer/quarterly-reports/ |

| Annual reports | https://rosseti-ural.ru/en/disclosure/issuer/annual-reports/ |

| GOVERNING AND CONTROL BODIES | https://rosseti-ural.ru/en/company/controls/ |

| HIGHLIGHTS | https://rosseti-ural.ru/en/company/highlights/finance/ |

‘

How can I know the exact amount of the Company’s shares owned by me?

To see the exact amount of the Company’s shares owned by you, you need to contact our registrar AOJoint-Stock Company STATUS at its HQheadquarters (located at: 23/1 Ulitsa Novokhokhlovskaya, Moscow, Russia, 109052) or its regional branches (explore the official registrar’s web-site at www.rostatus.ru to find the nearest office near you). Please, be aware that you should have your ID with you to pick up the account statement containing the exact amount of the Company’s shares owned by you.

I have problems with collecting dividends through my bank account, though general meetings of stockholders regularly vote for dividend allocation. What should I do to finally collect the dividends?

The problem seemingly lies in incorrect or fragmentary data regarding your bank account or taxpayer ID number. You should contact our registrar (AOJoint-Stock Company STATUS) to clear this up.

I do not receive the voting papers from your company to be able to vote at general meetings of stockholders. What should I do to start receiving the voting papers?

The register seemingly contains incorrect address details. To alter it, you should contact any registrar’s office, nearest to you. The registrar alters the register only using relevant data of a questionnaire completed by the stockholder. This questionnaire can be downloaded from the official registrar’s web-site (www.rostatus.ru) for completion. Alteration services are to be paid for in line with the current fees disclosed by the registrar. Please, explore the official registrar’s web-site to find more details on alteration procedure.

Focus on ESG investors

To enhance confidence of investors, consumers and other stakeholders, the Company strives to disclose, to the greatest possible extent, information on sustainable development factors (ESG-factors), which are the focus of attention of socially responsible investors during their investment decision-taking.

[1] As of 31.12.2022: PAOPublic Joint-Stock Company Rosseti is Public Joint-Stock Company Russian Grids;

As of 09.01.2023: PAOPublic Joint-Stock Company Rosseti is Public Joint-Stock Company Federal Grid Company – Rosseti (prior to 12.10.2022: PAOPublic Joint-Stock Company FSKFederal Grid Company of UESUnited Energy System).

[2] Section Incorporating Documents and Bylaws (Main/About us/ Incorporating Documents and Bylaws)